57+ what percentage of homeowners have no mortgage u.s. 2020

Web Surprisingly mortgage-free living is more common for homeowners who make less than 25000 a year. Housing Wire What percentage of homes are owner-occupied.

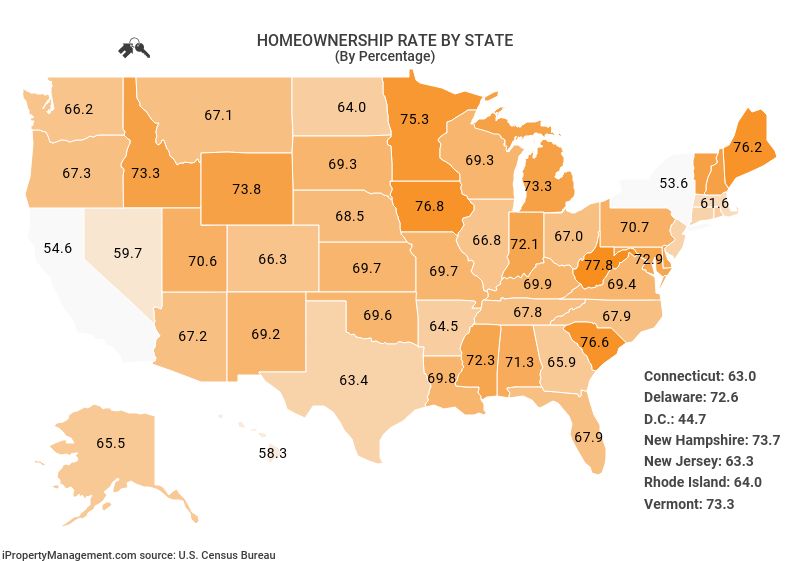

Homeownership Rates By State 2005 2023

This 07 percentage point increase in the homeownership rate.

. Only 11 percent of those surveyed reported that they plan to use a loan to fund their. Web The rate in Q2 of 2020 was higher by 38 from last years Q2 rate and 26 in Q1 of 2020. Only five states had fewer.

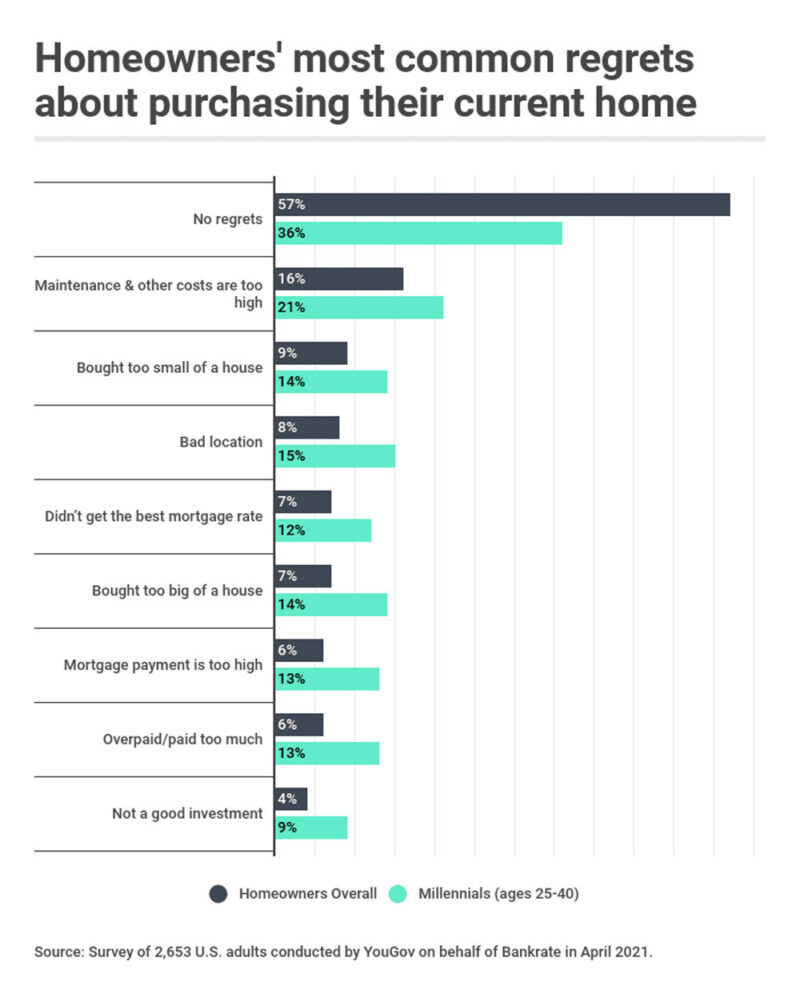

Web There are almost twice as many Baby Boomer homeowners 25661552 as there are Millennial homeowners in the 25-to-39 age group 12662948. Web Nearly 4 million people or just over 7 of mortgage holders have sought relief on their home loans as of April 30 according to housing data provider Black Knight. Home ownership decreased by 21 from 2009 to 2019.

Web As of the fourth quarter of 2020 658 of households own their homes up from 651 a year earlier. Highest Satisfaction for Mortgage Origination. Began at 653 in the first quarter of 2020 and ended at 655 by the fourth quarter of 2021.

Top-Rated Mortgage Loan Companies for 2022. Web The percentage of US households owned free and clear is a fair 37 according to Bloombergs data analysis from Zillow. Apply Online To Enjoy A Service.

Web Most homeowners 57 percent will pay for their project with a credit card. From 2009 to 2014 46 states and the District of. Web With 471 percent of all owner-occupied mortgages paid off New Mexico finishes first among states in the Southwest.

Web Though that figure increased to 47 for the second quarter of 2020 data from the US. Web The homeownership rate in 2019 was 641 up from the 63 in 2015 but below the peak years from 2005-2009. While much data is still being collected on.

Mortgage Company Reviews 2022. Web Homeownership rates in the US. Some 545 of low-income Americans have paid off.

Web The Millennial homeownership rate stands at 486 percent according to the most recent Census data more than 20 percentage points lower than the rate for Gen X. Ad Get the latest stats and analysis in the Mortgage industry. Web The average homeowner is 56 years old.

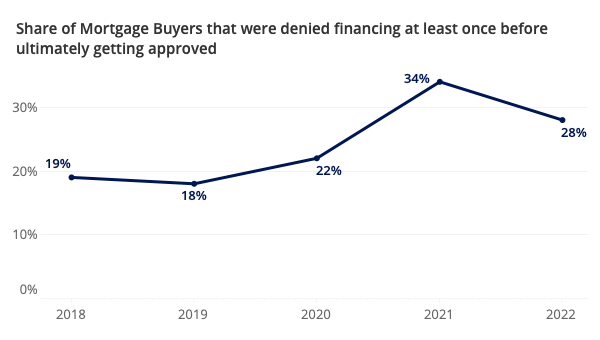

Web Nationally 264 of owners are mortgage-free. Even with interest rates. Ellie Mae Young people seem pretty wary about home ownership and big loans but the.

Homeowners have an all-time high median age of 57. Understand and monitor any market with our AI enabled Market Intelligence Platform. Among new homeowners who have been in their homes for less than.

The young adult homeownership rate. Census Bureau shows that Black Americans still have the lowest rate of. The past decade has seen a 55.

How Much You Can Save. Web In 2020 millennials accounted for 53 of home-purchase mortgages. Maryland lowest at 166 then Massachusetts 192 Utah 193 Rhode Island.

Part of the reason it boasts more mortgage. Web Nonetheless Americans owe 1192 trillion on their mortgages and mortgage debt accounts for 706 of consumer debt in the US. Web In other words this data doesnt show that 20 percent of Americans are homeowners whove paid off their mortgage debt only that 20 percent of housing units.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Trusted by 1000000 Users. Web Over 679 of Americans were homeowners in 2020.

Soc 153 Exam 3 Flashcards Quizlet

Which States Have The Most Mortgage Free Homeowners Move Org

10 States With The Most Mortgage Free Homeowners Moving Com

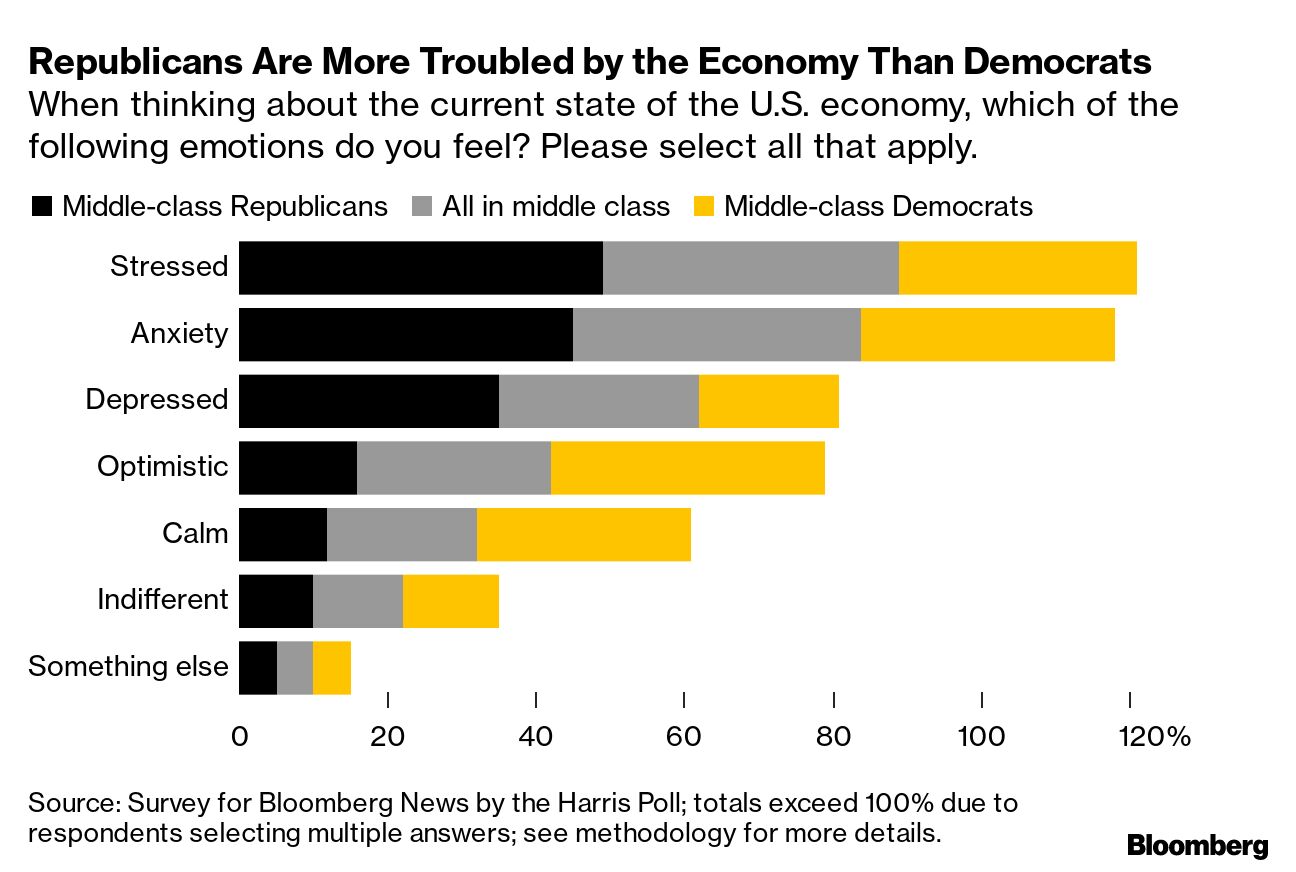

Inflation Has Middle Class Americans Worried About Economy Ahead

The Latest 2021 Statistics On Home Ownership In America

Buyers Results From The Zillow Consumer Housing Trends Report 2022 Zillow Research

Australasian Bus Coach 399 November 2020 By Prime Creative Media Issuu

Inflation Has Middle Class Americans Worried About Economy Ahead

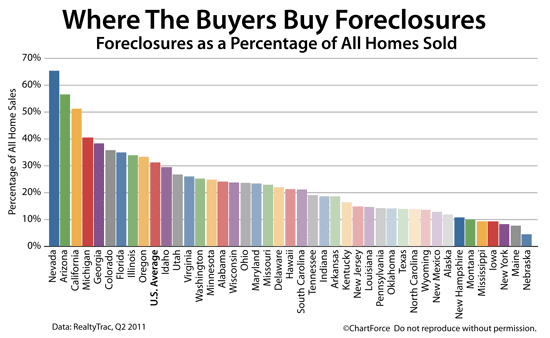

Foreclosures As A Percentage Of All Home Sales By State

Homeownership Facts And Statistics 2022 Bankrate

A Third Of California Homeowners Pay No Mortgage

Lenderoo We Make Mortgages Easy

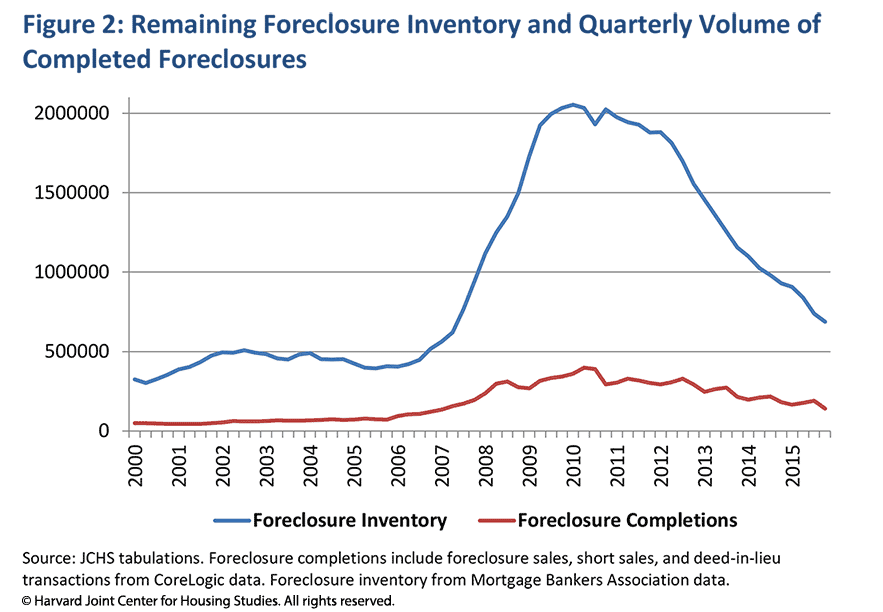

How Much Of The Homeownership Rate Decline From 2005 2015 Is Due To Foreclosures Joint Center For Housing Studies

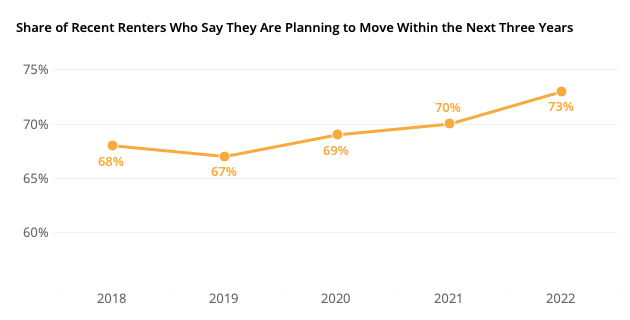

Renters Results From The Zillow Consumer Housing Trends Report 2022 Zillow Research

C Ville Weekly December 9 15 2020 By C Ville Weekly Issuu

Bad News For Tomorrow S Homeownership Rate

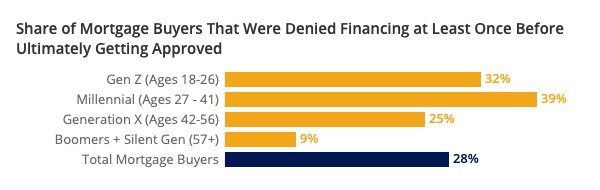

Buyers Results From The Zillow Consumer Housing Trends Report 2022 Zillow Research